Downtown St. Petersburg's condo market entered 2026 with dramatic price corrections—condo values dropped 12% year-over-year while single-family homes declined only 1.5%, creating the widest pricing gap since 2019. This divergence stems from rising HOA fees (averaging $375/month), insurance costs up 60% since 2019, and special assessment fears following Florida's post-Surfside building inspection mandates. Whether you're eyeing the new 46-story 400 Central tower or considering resale units in the EDGE District, understanding 2026's unique condo market dynamics is essential for making informed purchasing decisions.

For buyers exploring Tampa Bay real estate opportunities, downtown St. Pete condos now offer compelling value—but only if you know which red flags to avoid and which buildings represent solid long-term investments.

Why Condos Are Down 12% While Houses Hold Value

The 2026 pricing divergence between condos and single-family homes reflects specific structural challenges unique to Florida's condo market:

Insurance Crisis Impact: Florida homeowners insurance premiums surged 60% between 2019-2023, with condos hit hardest. According to Yahoo Finance, master policies covering entire condo buildings face even steeper increases, driving HOA fee spikes that price out buyers.

Post-Surfside Regulations: Florida now mandates structural inspections for buildings over 30 years old and three stories tall. Downtown St. Pete has 43 condo buildings meeting these criteria—inspection costs and required repairs trigger special assessments that can reach $100,000 per unit.

Buyer Demand Weakness: Attached homes face weaker demand as buyers calculate total monthly costs. A $400K condo with $450/month HOA fees costs the same monthly as a $465K single-family home with no HOA—and the house appreciates faster.

Reserve Fund Requirements: New Florida condo law requires fully-funded reserves for major repairs. Buildings that deferred maintenance now face catch-up assessments, making resale units riskier purchases than new construction with decades before major capital needs.

This creates opportunity for educated buyers who can identify well-managed buildings with healthy reserves and reasonable fee structures.

New Construction vs. Resale: The 2026 Reality

Downtown St. Petersburg's condo inventory splits into two distinct markets with fundamentally different risk profiles:

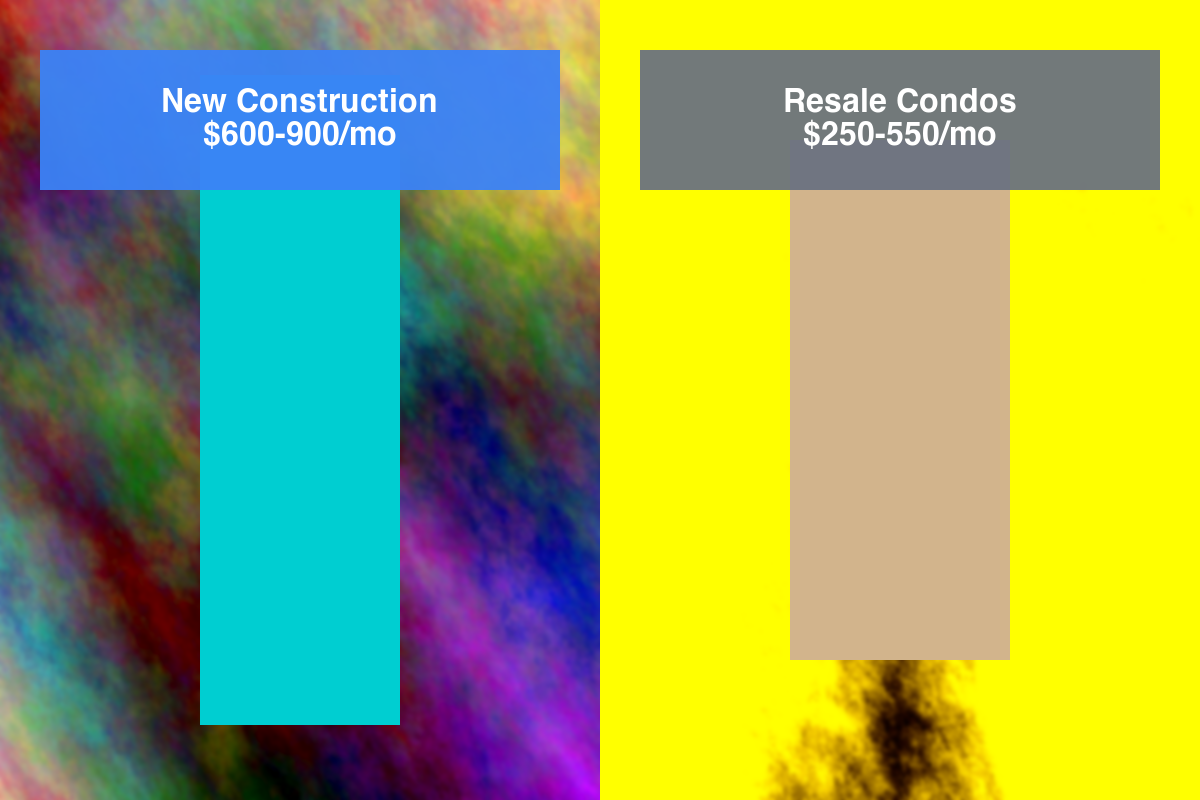

New Construction: Premium Pricing, Minimal Risk

400 Central (46 stories, 301 units)

- Status: Move-ins beginning January 2026

- Pricing: $700K-$3.5M ($850-$1,200/sq ft)

- HOA: $0.65-$0.85/sq ft ($600-$900/month typical)

- Advantage: No special assessments for 20+ years; modern systems

According to St Pete Rising, 400 Central is St. Petersburg's tallest building at 515 feet, featuring resort-style amenities that justify premium HOA fees through economies of scale.

The Julia (19 luxury residences)

- Status: Completion Q4 2025

- Pricing: $1.2M-$2.8M (boutique pricing)

- Size: 1,905-3,132 sq ft

- Target: High-net-worth buyers prioritizing exclusivity

Marina Bay Residence (12 stories, 96 units)

- Status: Construction starts Spring 2026, completion 2028

- Pricing: TBD (expect $600K-$1.8M)

- Location: Boca Ciega Bay waterfront

- Advantage: Pre-construction pricing before completion surge

For details on these projects, see Tampa Bay Business & Wealth.

Resale Market: Value Opportunities With Due Diligence Required

Median Resale Condo Prices (Downtown St. Pete, 2026):

- Studios: $185K-$280K

- 1-bedroom: $280K-$420K

- 2-bedroom: $420K-$650K

- 3-bedroom: $650K-$1.2M

Price Drops Create Entry Points: The 12% decline means a $500K condo in 2024 now sells for $440K—but only if you verify the building isn't facing deferred maintenance or special assessments.

High-Value Resale Buildings (low special assessment risk):

- ONE St. Petersburg (2014 construction): Modern systems, strong reserves

- ICON Central (2007): Well-managed, completed roof replacement 2023

- Park Tower (2008): Stable fees, healthy reserve fund

Risky Resale Buildings (avoid without deep due diligence):

- Buildings 30+ years old without recent major capital improvements

- Monthly fees under $300 (insufficient for proper maintenance)

- Reserve funds below 10% of annual budget

- History of special assessments exceeding $10K in past 5 years

The Real Cost of Ownership: Beyond the Purchase Price

St. Petersburg condo buyers in 2026 must calculate total monthly costs that extend far beyond mortgage payments:

Monthly Cost Breakdown Example

Scenario: $450K condo, 20% down, 7% mortgage rate

| Expense | Monthly Cost |

|---|---|

| Mortgage (principal + interest) | $2,394 |

| HOA fees | $450 |

| Property taxes | $450 |

| HO-6 insurance | $125 |

| Parking (if not included) | $150 |

| Pet fee (if applicable) | $50 |

| Total Monthly | $3,619 |

Critical: This same $3,619/month buys a $520K single-family home with no HOA—a property that historically appreciates faster and faces no special assessment risk.

Hidden Costs Buyers Miss

Special Assessments: According to Moneywise, some Florida condo owners paid $20,000+ in special assessments over two years. Point Brittany residents in St. Petersburg report assessments doubling their monthly costs.

Insurance Volatility: Master policy increases get passed through to unit owners via HOA fees. A building's insurance jumping 40% means your HOA fee increases $180/month overnight—and you can't shop for a better rate.

Reserve Funding Mandates: Florida law now requires full reserve funding. Buildings that previously waived reserves must catch up immediately, triggering one-time assessments of $15K-$50K per unit in older buildings.

Rental Restrictions: Many downtown condos prohibit short-term rentals or require 6-12 month minimum leases. If you're considering St. Petersburg vacation rental strategies, verify rental policies before purchasing.

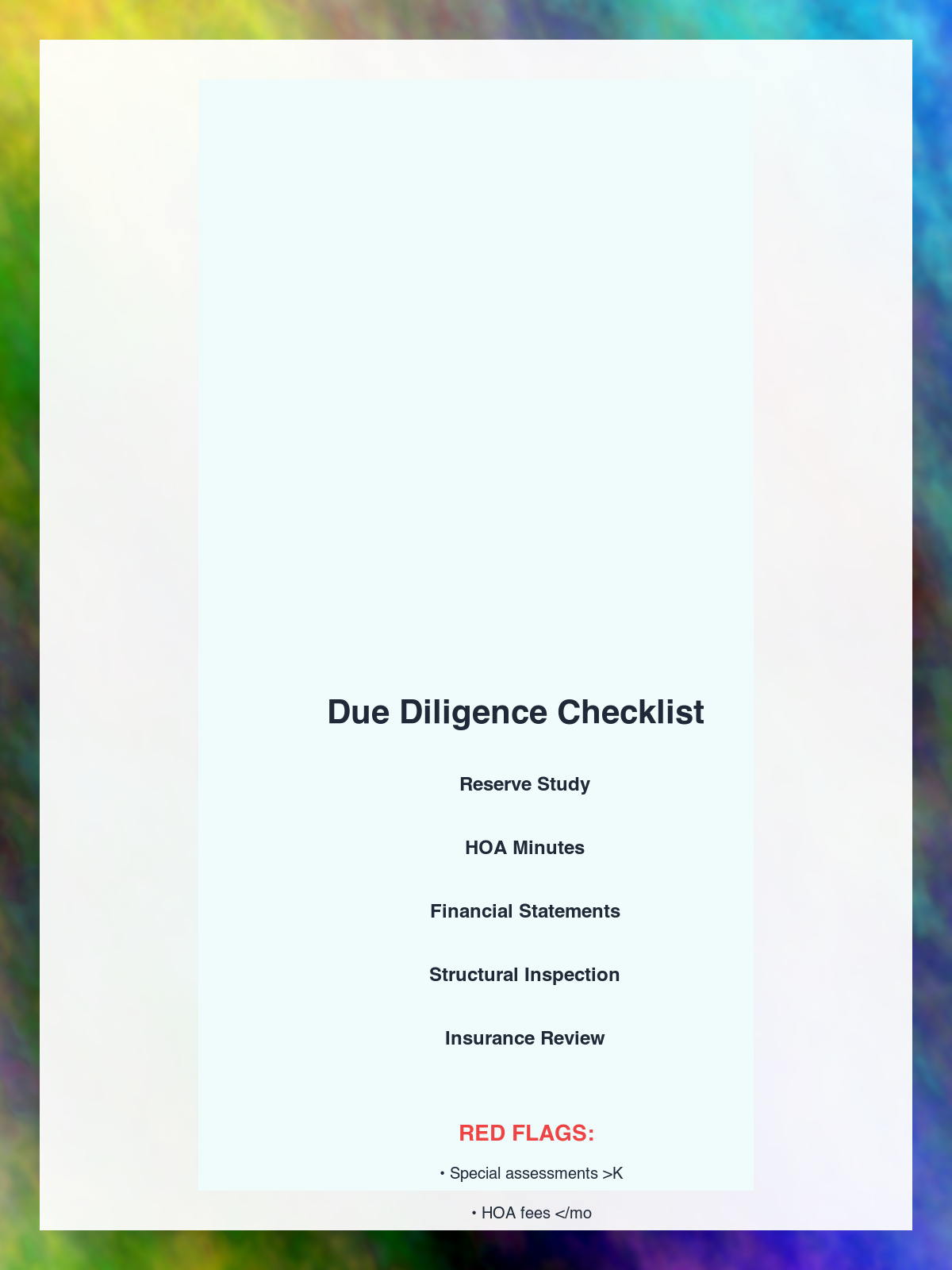

Critical Due Diligence: What to Review Before Buying

Florida's condo market requires scrutiny beyond standard home purchases. Follow this checklist:

Must-Review Documents

1. Reserve Study (last 3 years)

- Healthy reserve: 10-15% of annual budget minimum

- Red flag: Reserves below 5% or declining year-over-year

- Critical items: Roof, elevator, HVAC, seawall, parking structure

How to Read HOA Budgets in Downtown St. Pete Condos provides detailed guidance on budget analysis.

2. HOA Meeting Minutes (last 12 months)

- Look for: Discussion of special assessments, rising insurance costs, deferred maintenance

- Red flag: Contentious board votes, emergency meetings, legal disputes

- Green flag: Proactive capital planning, stable vendor relationships

3. Building Financial Statements

- Review: Assets, liabilities, accounts receivable (unpaid fees)

- Red flag: High delinquency rates (>5% of units behind on fees)

- Red flag: Operating at a deficit or borrowing to cover expenses

4. Structural Inspection Reports (for buildings 30+ years old)

- Required: Milestone inspections per Florida statute

- Critical: Phase 2 inspections revealing concrete degradation, rebar corrosion

- Deal-breaker: Major structural issues without funded repair plan

5. Insurance Coverage

- Master policy: Verify adequate coverage (not bare-bones to save money)

- Special assessment coverage: Does HO-6 policy cover your share?

- Wind/flood: Understand what master policy covers vs. your responsibility

According to GreatFlorida Insurance, special assessment coverage is now essential for Florida condo buyers.

Red Flags That Should Stop Your Purchase

- Special assessments exceeding $25K announced or under consideration

- Lawsuits against the HOA or unresolved legal issues

- Insurance coverage lapsed or major carrier canceled policy

- Deferred maintenance visible during walkthrough (water stains, rust, cracks)

- HOA fees increased >15% in past 2 years without corresponding improvements

- Reserve study shows major capital need (roof, HVAC) within 3-5 years without funding

Best Downtown St. Pete Neighborhoods for Condo Buyers

Downtown St. Petersburg's condo inventory clusters in distinct neighborhoods with different buyer profiles:

EDGE District: Creative Lofts and Warehouse Conversions

Character: Industrial-chic with brewery taprooms, art studios, and adaptive reuse projects Condo Types: Converted loft spaces, mid-rise new construction Price Range: $280K-$650K HOA Range: $250-$450/month

The EDGE District appeals to buyers wanting authentic urban living without luxury tower pricing. Properties here cater to creatives, young professionals, and buyers prioritizing neighborhood walkability over resort amenities.

Standout Building: Engine No. 9 Lofts (converted fire station)

Central Arts District: Gallery Views and Cultural Access

Character: Museum district with Dali, Chihuly Collection, and 30+ galleries Condo Types: Mixed-use buildings with ground-floor retail, mid-rise condos Price Range: $320K-$850K HOA Range: $300-$550/month

Central Arts District condos benefit from cultural tourism driving retail vitality and maintaining property values. Buyers here prioritize walkability to museums, theaters, and waterfront parks.

Considerations: Some buildings allow ground-floor commercial noise; visit during evening hours.

Waterfront High-Rise Corridor: Luxury Towers with Bay Views

Character: Premium high-rises along Bayshore Drive and Beach Drive Condo Types: 400 Central, ONE St. Petersburg, Salvador, Florencia Price Range: $500K-$3.5M HOA Range: $600-$1,200/month

This is downtown St. Pete's luxury condo market—resort amenities, concierge services, and Gulf/Bay views command premium pricing. HOA fees cover extensive amenities: pools, fitness centers, guest suites, and valet parking.

Target Buyer: High-income professionals, retirees, second-home buyers

Trade-off: Higher fees mean lower special assessment risk (better-funded reserves) but reduce monthly cash flow compared to smaller buildings.

2026 Market Timing: Is Now the Right Time to Buy?

Downtown St. Petersburg's condo market presents a narrow window for value-conscious buyers:

Why 2026 Favors Buyers:

- 12% Price Correction: Condos dropped more than single-family homes, creating relative value

- Inventory Surge: New construction completions (400 Central, The Julia) increase supply

- Seller Concessions: Motivated sellers offering closing cost credits, HOA fee coverage

- Extended Days on Market: Properties averaging 45-60 days vs. 25 days in 2022

According to Redfin's St. Petersburg Housing Market data, January 2025 saw 358 homes sold (up 29.2% year-over-year), indicating buyer activity is increasing as prices adjust.

Why This Window May Close:

- New Construction Absorption: Once 400 Central's 301 units sell out, resale inventory tightens

- Interest Rate Sensitivity: If rates drop below 6%, demand will surge and eliminate buyer leverage

- Insurance Stabilization: When insurance markets stabilize, HOA fee growth slows and prices rebound

- Reserve Funding Complete: Buildings completing catch-up assessments become more attractive

Strategic Timing:

- Q1-Q2 2026: Peak buyer opportunity as new construction competes with resale inventory

- Q3-Q4 2026: Market may stabilize as 400 Central sells out and rates potentially decline

- 2027: Expect pricing recovery as supply-demand balance shifts back toward sellers

For broader Tampa Bay context, see Tampa Bay Real Estate Market 2025 Analysis.

Financing Downtown Condos: What's Different in 2026

Condo financing carries additional requirements beyond single-family home mortgages:

Lender Requirements for Condos

Condo Certification:

- Lenders require buildings to meet Fannie Mae/Freddie Mac guidelines

- Red flags: >15% units investor-owned, >15% delinquent on fees, pending litigation

- Non-warrantable condos require portfolio lenders with higher rates

Down Payment:

- 10-20% minimum (higher than 3-5% FHA for houses)

- Investment properties: 20-25% down required

- Non-owner-occupied: Expect 25% down, higher rates

Appraisal Challenges:

- New construction lacks comparable sales (appraisers use builder pricing)

- Resale condos: Recent special assessments can reduce appraised values

- HOA fee levels affect affordability calculations and loan approval

Insurance Requirements:

- Lenders require proof of HO-6 policy before closing

- Master policy must meet lender standards (coverage amounts, wind/flood)

- Buildings with lapsed insurance cannot close mortgages

Alternative Financing Strategies

Portfolio Lenders:

- Local banks like Truist, Synovus offer non-QM condo loans

- Higher rates (7.5-9%) but flexible on building certification

- Useful for non-warrantable buildings or investor purchases

Cash Purchases:

- 35-40% of downtown condo sales are all-cash (investor activity)

- Cash eliminates condo certification requirements

- Refinance later once building meets Fannie/Freddie standards

Seller Financing:

- Rare but available in motivated seller scenarios

- Negotiate owner carry-back of 10-20% to reduce down payment need

- Typically 2-5 year balloon with refinance requirement

For first-time buyers, review our Pinellas County Home Buying Guide for down payment assistance programs.

Living Downtown: Beyond the Purchase Decision

Condo ownership in downtown St. Petersburg's 33701 zip code delivers a lifestyle fundamentally different from suburban Pinellas County:

True Walkability:

- Walk Score: 93-98 (car-optional living)

- Publix (4th Street), Whole Foods (1st Avenue) within 0.5 miles

- Central Avenue Trolley, PSTA buses eliminate car need

- Save $500-800/month eliminating second vehicle

Cultural Access:

- Dali Museum, Mahaffey Theater, Chihuly Collection walking distance

- 30+ galleries, live music venues, craft breweries in EDGE District

- Saturday Morning Market, Grand Central District events

Dining and Nightlife:

- 200+ restaurants within 1-mile radius

- Beach Drive dining corridor, Central Avenue bars

- Noise consideration: Visit Friday/Saturday nights before buying

Trade-offs vs. Suburban Living:

- Limited private outdoor space (balconies, not yards)

- Parking constraints ($100-300/month for second vehicle)

- Pet restrictions (size/breed limits common)

- Less privacy (shared walls, elevators, common areas)

Neighborhood Comparison:

- Unlike Clearwater Beach's tourism-focused market, downtown St. Pete functions as a true residential urban core

- More walkable than suburban Florida neighborhoods requiring cars for daily errands

Conclusion

Downtown St. Petersburg's condo market in early 2026 presents a calculated opportunity for informed buyers—12% price corrections, new luxury inventory from 400 Central and The Julia, and motivated sellers create negotiating leverage not seen since 2019. However, success requires rigorous due diligence on HOA financials, reserve studies, and special assessment risks that distinguish well-managed buildings from ticking time bombs.

The pricing gap between condos (down 12%) and single-family homes (down 1.5%) reflects real structural challenges—rising insurance costs, post-Surfside inspection mandates, and reserve funding requirements. Buyers who understand these dynamics can identify value while avoiding the $20,000+ special assessment disasters plaguing Point Brittany and similar communities.

For expert guidance on navigating downtown St. Pete's condo market, vetting HOA documents, and identifying buildings with strong financial health, contact Mangrove Bay Realty.

📞 Call us: (727) 625-1777 📧 Email: troynowakrealty@gmail.com 🌐 Visit: mangrovebayrealty.com

Author: Troy Nowak, Licensed Florida Real Estate Broker Office: 330 3rd Street South, St. Petersburg, FL 33701

Disclaimer: This guide provides general information about downtown St. Petersburg's condo market as of January 2026. Market conditions change rapidly. HOA fees, special assessments, and building financial health vary significantly between properties. Always conduct thorough due diligence, review all condo documents with a real estate attorney, and consult with qualified professionals before making purchasing decisions. This content does not constitute legal, financial, or investment advice.