Everything you need to know about flood zones before buying property in Tampa Bay

After Hurricane Helene's devastating impact on Pinellas County in September 2024, understanding flood zones has become more critical than ever for home buyers. With FEMA updating flood maps and insurance requirements changing rapidly, navigating Pinellas County's flood zones can make or break your real estate investment.

This comprehensive guide covers everything you need to know about flood zones in Pinellas County, from understanding FEMA maps to calculating insurance costs and making informed buying decisions in St. Petersburg, Clearwater, and surrounding areas.

Key Takeaway: Pinellas County flood zones directly impact your insurance costs, financing options, and property values. With Hurricane Helene's aftermath still affecting the market, understanding flood risk is essential for every Tampa Bay home buyer.

Understanding Pinellas County Flood Zones

What Are Flood Zones?

Flood zones are geographic areas defined by FEMA (Federal Emergency Management Agency) based on their risk of flooding. These zones determine:

- Insurance Requirements: Which properties must carry flood insurance

- Insurance Costs: Premium rates based on risk level

- Financing Options: Lender requirements for flood insurance

- Property Values: Market impact of flood risk

- Building Codes: Construction requirements for flood-prone areas

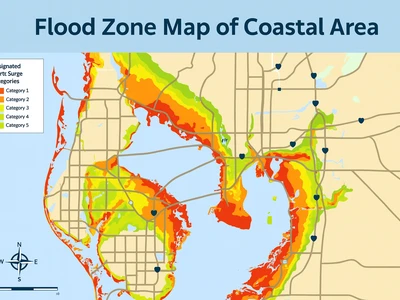

Pinellas County's Unique Flood Risk

Pinellas County faces unique flood challenges due to its geography:

Geographic Factors:

- Peninsula Location: Surrounded by water on three sides

- Low Elevation: Most areas are just feet above sea level

- Storm Surge Risk: Hurricane impacts from Gulf of Mexico and Tampa Bay

- Urban Development: Extensive paving reduces natural drainage

- Climate Change: Rising sea levels increasing flood risk

Recent Impact: Hurricane Helene (September 2024) caused significant flooding throughout Pinellas County, particularly in:

- St. Petersburg coastal areas

- Clearwater Beach and surrounding neighborhoods

- Indian Rocks Beach and Treasure Island

- Madeira Beach and Redington Beach

FEMA Flood Zone Classifications

High-Risk Flood Zones (Require Flood Insurance)

Zone AE (1% Annual Chance Flood)

- Risk Level: High

- Description: Areas with 1% annual chance of flooding (100-year flood)

- Insurance: Required for properties with federally backed mortgages

- Premium Range: $400-$2,000+ annually

- Common in Pinellas: Coastal areas, waterfront properties, low-lying neighborhoods

Zone VE (Coastal High Hazard)

- Risk Level: Very High

- Description: Coastal areas with 1% annual chance of flooding + wave action

- Insurance: Required, highest premiums

- Premium Range: $1,500-$8,000+ annually

- Common in Pinellas: Beachfront properties, barrier islands

Zone AO (Shallow Flooding)

- Risk Level: High

- Description: Areas with 1% annual chance of shallow flooding (1-3 feet)

- Insurance: Required

- Premium Range: $300-$1,500 annually

- Common in Pinellas: Some inland areas near water bodies

Moderate-Risk Flood Zones

Zone X (Shaded)

- Risk Level: Moderate

- Description: Areas with 0.2% annual chance of flooding (500-year flood)

- Insurance: Not required but recommended

- Premium Range: $200-$800 annually

- Common in Pinellas: Most inland areas

Low-Risk Flood Zones

Zone X (Unshaded)

- Risk Level: Low

- Description: Areas outside 500-year floodplain

- Insurance: Not required

- Premium Range: $200-$500 annually (if purchased)

- Common in Pinellas: Higher elevation areas, some newer developments

Pinellas County Flood Zone Map by City

St. Petersburg Flood Zones

High-Risk Areas (AE/VE Zones):

- Downtown Waterfront: Along Tampa Bay

- Old Northeast: Parts near waterfront

- Snell Isle: Island community

- Shore Acres: Coastal neighborhood

- Coquina Key: Waterfront area

- Riviera Bay: Coastal community

Moderate-Risk Areas (X Shaded):

- Historic Kenwood: Most of neighborhood

- Greater Pinellas Point: Inland areas

- Midtown: Central areas

- Childs Park: Most of neighborhood

Low-Risk Areas (X Unshaded):

- Pinellas Point: Higher elevation areas

- Tyrone: Most of neighborhood

- Gateway: Newer developments

Clearwater Flood Zones

High-Risk Areas (AE/VE Zones):

- Clearwater Beach: Entire barrier island

- Sand Key: Barrier island

- Belleair Beach: Coastal area

- Belleair Shore: Waterfront community

Moderate-Risk Areas (X Shaded):

- Downtown Clearwater: Parts near waterfront

- North Greenwood: Some areas

- Countryside: Most of community

Low-Risk Areas (X Unshaded):

- East Lake: Higher elevation

- Safety Harbor: Most areas

- Oldsmar: Most areas

Other Pinellas County Cities

High-Risk Areas:

- Indian Rocks Beach: Entire barrier island

- Treasure Island: Entire barrier island

- Madeira Beach: Entire barrier island

- Redington Beach: Entire barrier island

- Belleair Bluffs: Parts near water

Moderate-Risk Areas:

- Largo: Most areas

- Seminole: Most areas

- Pinellas Park: Most areas

- Kenneth City: Most areas

How Flood Zones Affect Home Buying

Insurance Requirements and Costs

Federally Backed Mortgages (FHA, VA, Conventional)

- Properties in AE, VE, AO zones require flood insurance

- Must maintain coverage for life of loan

- Coverage amount: Outstanding loan balance or property value (whichever is less)

Private Mortgages

- Lender discretion on flood insurance requirements

- May require insurance even in moderate-risk zones

- Often required for properties near water

All-Cash Purchases

- No lender requirements

- Still recommended for high-risk zones

- Protects your investment

Insurance Cost Breakdown

Zone AE Premiums (Annual):

- Base Premium: $400-$800

- Contents Coverage: $200-$500

- Deductible: $1,000-$5,000

- Total: $600-$1,300+

Zone VE Premiums (Annual):

- Base Premium: $1,500-$4,000

- Contents Coverage: $500-$1,000

- Deductible: $2,000-$10,000

- Total: $2,000-$5,000+

Zone X Premiums (Annual):

- Base Premium: $200-$400

- Contents Coverage: $100-$300

- Deductible: $1,000-$2,500

- Total: $300-$700

Financing Impact

Conventional Loans:

- Require flood insurance in high-risk zones

- May require in moderate-risk zones

- Affects debt-to-income ratios

FHA Loans:

- Always require flood insurance in high-risk zones

- Stricter requirements than conventional

- May limit loan amounts

VA Loans:

- Require flood insurance in high-risk zones

- Veterans may qualify for reduced rates

- No PMI requirement helps offset costs

Cash Purchases:

- No lender requirements

- Still recommended for protection

- Can negotiate better terms

Post-Hurricane Helene Market Changes

Insurance Market Disruption

Carrier Withdrawals:

- Several insurers stopped writing policies in Pinellas County

- Citizens Property Insurance (state insurer) taking more policies

- Higher premiums across all zones

New Requirements:

- Stricter underwriting standards

- Higher deductibles

- More exclusions and limitations

Market Impact:

- Properties in high-risk zones harder to insure

- Some properties uninsurable

- Buyers requiring all-cash offers

Property Value Changes

High-Risk Zones (AE/VE):

- Price Reductions: 10-25% post-Helene

- Longer Market Time: 60-120+ days

- Cash-Only Sales: Many sellers requiring cash

- Lower Appraisals: Appraisers factoring in flood risk

Moderate-Risk Zones (X Shaded):

- Minimal Impact: 0-5% price changes

- Normal Market Time: 30-60 days

- Financing Available: Most lenders still active

- Stable Appraisals: Less impact on valuations

Low-Risk Zones (X Unshaded):

- Price Stability: No significant changes

- Fast Sales: 15-30 days average

- Full Financing: All loan types available

- Strong Appraisals: No flood-related issues

How to Check Flood Zones Before Buying

Online Resources

FEMA Flood Map Service Center

- Official FEMA flood maps

- Property-specific flood zone lookup

- Historical map changes

- Elevation certificates

Pinellas County Property Appraiser

- Property search by address

- Flood zone information

- Property characteristics

- Tax assessment data

Pinellas County GIS Maps

- Interactive flood zone maps

- Property boundaries

- Elevation data

- Aerial photography

Professional Services

Flood Zone Determination

- Licensed surveyors

- Engineering firms

- Real estate professionals

- Insurance agents

Elevation Certificates

- Required for accurate insurance quotes

- Shows exact elevation above base flood

- Can reduce insurance premiums

- Valid for 5 years

What to Look For

Red Flags:

- Property in AE, VE, or AO zones

- Recent flood damage history

- High insurance quotes

- Seller requiring cash offers

- Long days on market

Green Flags:

- Property in Zone X (unshaded)

- No recent flood damage

- Reasonable insurance costs

- Financing readily available

- Normal market activity

Flood Insurance: What You Need to Know

National Flood Insurance Program (NFIP)

Coverage Limits:

- Building: Up to $250,000

- Contents: Up to $100,000

- Waiting Period: 30 days (except for purchases)

- Policy Term: Annual renewable

Coverage Details:

- Building Coverage: Structure, foundation, electrical, plumbing

- Contents Coverage: Personal belongings, furniture, appliances

- Additional Living Expenses: Temporary housing during repairs

- Basement Coverage: Limited coverage for below-grade areas

Private Flood Insurance

Advantages:

- Higher coverage limits

- Shorter waiting periods

- More flexible terms

- Better customer service

Considerations:

- Higher premiums

- Stricter underwriting

- Limited availability

- Less government backing

Cost-Saving Strategies

Elevation Certificates:

- Can reduce premiums by 20-60%

- Shows property elevation above base flood

- Required for accurate rating

- Valid for 5 years

Community Rating System (CRS):

- Pinellas County participates

- Discounts for flood mitigation

- Up to 45% premium reduction

- Based on community flood management

Grandfathering:

- Older properties may qualify

- Based on previous flood maps

- Can maintain lower rates

- Subject to policy changes

Making Smart Buying Decisions

High-Risk Zone Properties

When to Consider:

- Significant price discount (20%+)

- All-cash purchase capability

- High tolerance for risk

- Investment property with strong cash flow

- Long-term hold strategy

When to Avoid:

- Tight budget with no insurance buffer

- First-time homebuyer

- Short-term ownership plans

- Reliance on conventional financing

- Low risk tolerance

Moderate-Risk Zone Properties

Good Options For:

- Most homebuyers

- Conventional financing

- Reasonable insurance costs

- Balanced risk/reward

- Long-term ownership

Considerations:

- Insurance still required by some lenders

- Premiums can increase

- Flood risk exists but manageable

- Good value proposition

Low-Risk Zone Properties

Ideal For:

- All buyer types

- All financing options

- Minimal insurance concerns

- Maximum financing options

- Peace of mind

Trade-offs:

- Higher property prices

- More competition

- Less negotiation room

- Premium locations

Working with Real Estate Professionals

Choosing the Right Agent

Look For:

- Local flood zone expertise

- Insurance agent connections

- Experience with post-Helene market

- Knowledge of financing options

- Flood mitigation resources

Questions to Ask:

- How do you help clients navigate flood zones?

- Do you have insurance agent referrals?

- What's your experience with flood-affected properties?

- How do you handle flood zone disclosures?

- Can you help with elevation certificates?

Due Diligence Process

Property Investigation:

- Flood zone verification

- Insurance quote procurement

- Elevation certificate review

- Flood damage history

- Mitigation measures

Financing Preparation:

- Lender flood insurance requirements

- Debt-to-income calculations

- Down payment considerations

- Closing cost estimates

- Monthly payment projections

Future Outlook: Climate Change and Flood Risk

Rising Sea Levels

Projections:

- 1-2 feet by 2050

- 3-6 feet by 2100

- Accelerating rate of increase

- Regional variations

Impact on Pinellas County:

- More properties entering flood zones

- Higher insurance premiums

- Increased flood frequency

- Property value implications

FEMA Map Updates

Recent Changes:

- Post-Hurricane Helene updates

- More accurate risk modeling

- Expanded high-risk zones

- Updated base flood elevations

Future Updates:

- Climate change considerations

- More frequent revisions

- Stricter building codes

- Enhanced mitigation requirements

Adaptation Strategies

Property Level:

- Elevation improvements

- Flood-resistant construction

- Drainage improvements

- Backup power systems

Community Level:

- Stormwater management

- Flood control infrastructure

- Building code updates

- Emergency preparedness

Your Pinellas County Flood Zone Checklist

Before You Start Looking

- Understand your risk tolerance

- Determine insurance budget

- Research financing requirements

- Identify preferred flood zones

- Find qualified real estate agent

During Property Search

- Check flood zone for each property

- Get insurance quotes

- Review elevation certificates

- Check flood damage history

- Verify financing options

Before Making an Offer

- Confirm flood zone classification

- Lock in insurance quote

- Verify lender requirements

- Calculate total monthly costs

- Review flood mitigation options

During Due Diligence

- Order elevation certificate

- Finalize insurance policy

- Complete flood zone verification

- Review flood disclosures

- Plan for mitigation measures

At Closing

- Confirm insurance coverage

- Review flood zone documentation

- Understand policy terms

- Set up premium payments

- Keep elevation certificate

Ready to Navigate Pinellas County Flood Zones?

Understanding flood zones is crucial for making informed real estate decisions in Pinellas County. With Hurricane Helene's impact still affecting the market and climate change increasing flood risk, working with experienced professionals is more important than ever.

Our team specializes in helping buyers navigate flood zones and insurance requirements throughout Pinellas County. We provide:

✅ Flood Zone Analysis for every property you consider

✅ Insurance Agent Referrals for competitive quotes

✅ Financing Guidance for flood-affected properties

✅ Due Diligence Support including elevation certificates

✅ Market Expertise in post-Hurricane Helene conditions

Don't Let Flood Zones Surprise You! 👉 Contact us today for a free consultation. We'll help you understand flood risk, insurance costs, and financing options before you make an offer.

Related Resources on Our Site

Explore more Tampa Bay and Pinellas County real estate guides:

- Everything You Need to Know About Flood Insurance Before Investing in Pinellas County – Comprehensive flood insurance guide

- Florida Homeowners Insurance in 2025: What Pinellas County Buyers Need to Know – Current insurance market insights

- Tampa Bay Buyer's Market 2025: Best Opportunities for Home Buyers in Pinellas County – Current market conditions

- Moving to Pinellas County: Complete 2025 Guide – Comprehensive relocation guide

- Living in Tampa vs. Saint Petersburg: Which Florida City Fits You? – Compare Tampa vs St Pete

About Mangrove Bay Realty

Mangrove Bay Realty is a full-service real estate brokerage specializing in buyer representation throughout Pinellas County and Tampa Bay.

Our team provides:

- Comprehensive flood zone analysis and insurance guidance

- Expert navigation of post-Hurricane Helene market conditions

- Insurance agent referrals specializing in Florida coastal properties

- Lender connections with competitive rates and flood insurance expertise

- Due diligence support including elevation certificates and flood zone verification

- Investment property analysis considering flood risk and insurance costs

Serving St. Petersburg, Clearwater, Largo, Tampa, Seminole, Pinellas Park, Indian Rocks Beach, Treasure Island, Madeira Beach, and all of Pinellas County.

📞 Call us: (727) 625-1777

📧 Email: troynowakrealty@gmail.com

🌐 Visit: mangrovebayrealty.com

Last Updated: January 15, 2025

Disclaimer: This guide is for informational purposes only and does not constitute financial, legal, or insurance advice. Flood zone classifications and insurance requirements are subject to change. Always verify current information with local real estate professionals, insurance agents, and lenders before making purchase decisions.